US is in a Recession – Keep Shorting the Market

I am basing this on several indicators. And finally some banks come to the same conclusion. Inflation always precedes a recession. I will continue to short the market. Buy long term long Put or Sell Call Credit Spreads

#1 Inverted Yield Curve

But one of the most important is the INVERTED YIELD CURVE. Every time you can get more interests for short term assets than for long term assets you invert the interest curve. The only thing is that we call the interest paid on bonds and notes YIELDS. So the yield curve inverts. Below you see what I mean by that.

When yield of shorter term assets increase and converge with longer term assets they all squeeze in on top of each other. And when you subtract i.e. the 5 year Treasury Note from the 10 year, or the 5 year note from the 20 year bond you might get a negative number because the shorter term asset is more worth that the longer term asset.

This shows mistrust in the economy and a crash is immanent. A recession has been born.

Lets take a look at the DOT COM Bubble, the FINACIAL Bubble, the forming recession under Trump and look at now. We can see the similarities.

#2 Disposable Income and Savings

In this graph we can see that people saved a lot of money when the China Virus hit, the government spent a lot of money to keep people at home. Reduced production and increased money supply = Inflation. The STIMMIES. This happened under Trump and under Biden. We can see in the black line how under Trump /China Virus and later under Biden /Socialist agenda the disposable income increases and is flattening since. Then the purple line shows that there is an increased spending of the consumers. But I would be very careful here since this seems more due to increased prices and inflation and not due to increased buying. We also see that the saving rate is below 2015 level now. A strong indicator that people run out of money. Disposable income and Savings down but Expenditures up = Inflationary pressure. When buying power diminishes, retail inventory will increase and then ORDERS will also slow down, Lay offs are coming

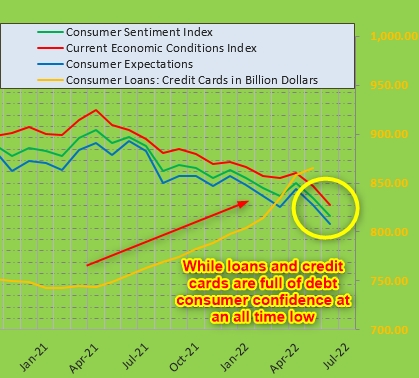

#3 Consumer Expectations and Conditions

Consumers expectations and current conditions are worse than they were when the China Virus hit. The enthusiasm for the socialist Biden economy lasted exactly from January to March 2021. From there on it is all downhill!

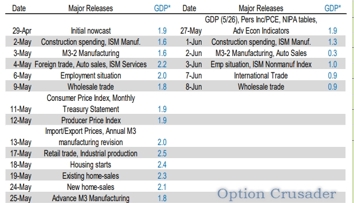

#4 GDP Growth

Further suggesting a recession is the slagging economy. Just hoovering around zero in the beginning of January the GDP forecast just climbed up to 1.1%. Mostly the PPI (Producer Prices Index) for all sectors and industries is still astronomically high. These are the input prices for goods sold to consumers. PPI will increase the CPI as we already saw in the graphs above.

#5 Rising Prices and Wage Gap

Rising prices outpace wage increases. New data coming out next week but we can see where the trend is. It is obvious that producer prices are rising since the take over of the Biden administration. This is NOT a result of government imposed shortages or Bidens over regulations. Prices went up not only in one industry but in all. And that is always a monetary phenomena. This is the result of creating money out of thin air by the FEDs without producing goods. Hence more money is chasing fewer goods and hence prices rise. We also can see that a lot of the Stimmie money went into the stock market, retail traders sign for about 20% of the transaction in the stock market, correct me if I am wrong. And it takes about 6-12 months before you see the effects. And here they are. The exception might be energy prices. They were increasing rapidly when the administration disallowed drilling in Alaska, drilling on public land and stop fracking. That massively reduced supply while demand is increasing. Higher gas prices at the pump are in fact result of shortages created by the government.

We can see that wages are not in line with inflation but falling way behind. This will reduce consumption, spending, hence production, coming lay offs and cooling off demand.

The Feds seem to be committed to rate hikes, which will cool off the housing market big time because lending rates will go up with the Feds rate hike.

To be continued.