ATR and Historical Volatility in a Spread Trade

Working with weekly charts I love the IWM. Why is that? Because it has not moved much in over a year as we can see in the black line in the image. It is also said that the IWM is a leading indicator and shows the way of the SPX and NASDAQ ETFs.

Back Testing

Even in a very ranging market we can pick entry points by crossing over Monthly Annualized HISTORICAL VOLATILITY, the red line and the ATR, also an Volatility indicator, the green line.

Every time the ATR falls below the HISTORICAL VOLATILITY the market has a down turn.

Every time the ATR breaks above the HISTORICAL VOLATILITY the market has an upturn. We collect data on weekly charts! Back testing the data for 16 months comes up with an 93.75% winning chance. One loser out of 16 trades and one break even.

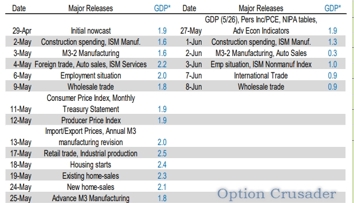

You pull the data from Finance.Yahoo.com, every FRIDAY. 5 years term, weekly charts. Put it into my option analysis spread sheet. Calculate ATR, HIST VOL and 2.5 StaDev. Enter trade the following Monday.

The Data

Managing Loosing Trades

Max Losses are calculated as well. If nothing is done on a losing trade max losses will occur and reduce your all over all performance. Why? Because your losses are approximately 10 fold your gains.

In order to reduce risk and minimize losses you have to cut losses somehow. There are 3 options that work for me in a credit spread.

- Buy back at Strike for a loss

- Buy back at BE for a bigger loss

- Covert the Credit Spread into an Iron Fly, which locks in the loss at e lover rate. This additional credit spread can go for one week and there is not much difference to a 2 week spread but by selling it you cash in quite some money that reduces you all over all losses on a losing trade.

This all means that the trade might make a 95% return on your capital. One loosing trade and one BE trade. This is a 93.75% winning or BE strategy. 6.25% loosing trades.

The Break Even Trade

The BE trade will not generate a loss even your Strike is hit. Why? Because you already received a credit and you have to deduct that from the losses.

In our 15th trade on January 24th, the IWM hit Strike Price by one Dollar. The trade was entered when the unde4rlaying was at $194 with the short leg at $208 and the hedging long leg at 213. Since the BE price was at 210.13 and the underlaying never went below that but settled at 209 (41.00 below the strike of $208) the trade did not loose. It just went by like a close call bullet. Thats why trade #15 has no P/L values.